Timing of Monthly Subscription

Over a long horizon, you can make total revenue essentially the same under calendar-month or same-day-of-month (“anniversary”) billing. But your cash flow timing (and the operational reality around it) will look very different: calendar months cluster cash while anniversary billing spreads it across the whole month.

The two approaches

Calendar-month billing with proration

-

Rule: Everyone’s “anchor” is the 1st of the month. If you start mid-month, you pay a prorated amount for the remainder of that month, then the full price on the 1st going forward.

-

Proration: Most teams use a daily approach

Example (Monthly price = $100, start Jan 10, 2022):

- January has 31 days so days remaining is 22.

- First charge on Jan 10: $100 x (22/31) = $70.97.

- Then $100 on Feb 1, Mar 1, etc.

Edge case (start Jan 31, 2022):

- Days remaining in Jan = 1. First charge on Jan 31: $100 x (1/31) = $3.23.

- Then $100 on Feb 1, Mar 1, etc.

- Note: perfectly fair if you ignore that first day and simply charge the customer on Feb 1st.

Same-day-of-month billing

- Rule: You pay on the same calendar day you started. If you sign up on the 10th, you renew on the 10th of each following month.

- No proration: Most teams charge the full price on the signup day, then the same amount on that day of each subsequent month. For dates that the calendar does not repeat (e.g., the 31st), billing systems usually fall back to the last day of the shorter month.

Contrast with the examples above:

- Jan 10 start → first cash under same-day billing is $100 (vs $70.97 prorated on calendar), then $100 again on Feb 10, Mar 10, etc.

- Jan 31 start → next charge lands Feb 29 or Feb 28 when the 31st does not exist, then Mar 31, Apr 30, etc.

Revenue neutrality

If you price both approaches at the same value (e.g. $100 per month) and customers stick around, you’ll collect 12 payments per year in either system once the account is past the signup month. The only structural difference is the stub month:

- Calendar-month proration collects only the portion of the first month that the customer actually receives.

- Same-day-of-month billing collects a full invoice upfront, even if there are only a few service days before the next renewal.

So calendar-month billing defers part of the first invoice to the next month, while anniversary billing pulls that cash forward. Over long lifetimes the difference becomes negligible, but if churn is heavy in the first month you may see slightly higher realized revenue under same-day billing. Some teams smooth this by offering a prorated credit on the second invoice, but most simply keep the full-charge-on-signup rule and communicate it clearly.

The real difference: cash flow timing

Even if total revenue is aligned, when the cash lands is different:

- Calendar-month: Big, predictable spikes on the 1st (plus scattered proration on signup days).

- Same-day-of-month: Cash is distributed across the 1st through 31st based on when customers signed up; only anniversary cohorts line up on the same day.

Why it matters:

- Forecasting & runway: Calendar-month gives CFOs an easy “cash day” for reconciliation, sweeps, and covenant checks. Same-day billing smooths daily balances because renewals are naturally scattered.

- Collections & dunning: Calendar-month concentrates payment retries on a handful of days; if your processor has rate limits or you have ops staffing constraints, that can be painful. Anniversary billing spreads failures and retries naturally.

- Customer experience: Calendar months are intuitive (“pay on the 1st”); anniversary billing mirrors typical “every month on your signup date” consumer expectations but requires clarity for end-of-month signups.

- Accounting & reporting: P&L and board reporting are monthly. Calendar billing aligns cleanly with that cadence; anniversary cycles require more accruals/deferrals crossing month boundaries. Modern systems handle it, but it’s extra rope you must manage.

- System complexity: Calendar-month with proration brings edge cases around month lengths (28/29/30/31) and partial periods—but most billing stacks handle this natively. Anniversary billing relies on a reliable “same day” roll forward (with end-of-month fallbacks) and avoids proration logic.

A simple simulation

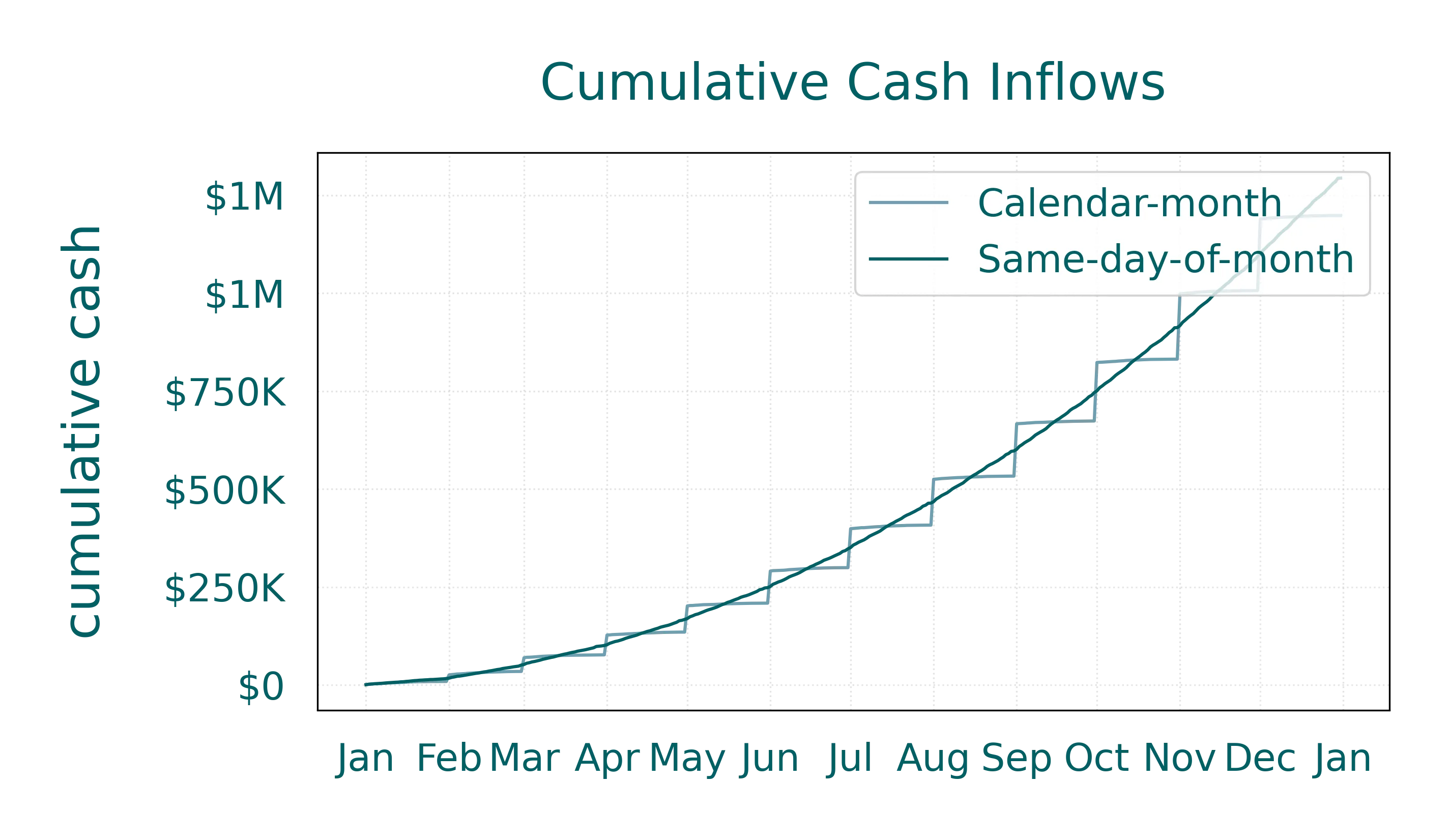

We can code a simulation to generate cash inflows under both methods, and plot cumulative cash to highlight how the cash timing differs.

Assumptions

- $100 plan, customers sign up uniformly throughout the year, no churn, no failures.

- Calendar-month uses daily proration by actual days in month.

- Anniversary billing charges the full price on signup day and then on the same day of each subsequent month (falling back to the last day if that date does not exist).

Results

- The calendar-month cumulative line will jump at the start of each month (plus a small amount of proration spread across signup days).

- The same-day-of-month line climbs more smoothly, because renewals are distributed across the 1st-31st instead of clustering on the 1st.

- In one sample run with 2,000 uniform signups and a $100 plan, about 92% of calendar-month cash landed on the twelve 1st-of-month days, while the biggest single day under anniversary billing accounted for just ~5% of annual cash. Your exact numbers will vary with volume, churn, and pricing, but the shape is robust.

Implications for the team

Finance & cash ops

- Predictability vs. smoothness:

- Calendar-month gives a highly predictable cash day for liquidity planning, bank transfers, and variance analysis.

- Same-day-of-month smooths inflows and reduces peak loads (potentially friendlier to coverage ratios that look at daily balances), but you lose the single “cash spike” for easy reconciliation.

- Dunning dynamics:

- Calendar-month concentrates retries; make sure risk limits and support staffing are prepared for 1st-of-month waves.

- Anniversary billing naturally staggers failures and saves. This can dampen operational peaks.

Customer experience

- Mental model: “Pay on the 1st” is obvious. Anniversary billing mirrors the familiar “renews on your signup date” experience but still needs clear messaging for end-of-month signups when the date shifts.

- Fairness narrative: Proration feels fair and transparent. You’ll get the occasional “Why is February the same price?” question; it’s worth a short FAQ.

Accounting & reporting

- Alignment with months:

- Calendar billing aligns cash to month-ends; you still recognize revenue ratably, but the cash ties out to monthly close more intuitively.

- Anniversary cycles mean more revenue crossing month boundaries; your deferred revenue and accrual schedules must be crisp. Most rev-rec tools handle both, but your close checklist grows a little.

Engineering & systems

- Complexity profile:

- Calendar-month requires solid proration logic (actual days in month, leap years, end-of-month signups).

- Anniversary cycles are mechanically simple, but they decouple from the calendar, so reporting joins (e.g., cohort cash by calendar month) take more care.

- Payments throughput: If you process most charges on ~12 days a year, design for throughput spikes and watch provider rate-limit policies. Anniversary cycles are kinder to throughput—and to support teams.

When to pick which

Choose Calendar-Month (prorated) if…

- You want simple mental models (“We bill on the 1st”).

- Your finance team prefers monthly spikes for reconciliation and cash control.

- Most of your reporting/OKRs are monthly and you’d rather minimize accrual gymnastics.

Choose Same-Day-of-Month if…

- You value smooth daily cash (e.g., to reduce peak working-capital swings or processor load).

- You operate at scale where throughput peaks or support surges on the 1st are painful.

- You’re comfortable mapping anniversary cash back to calendar months in your reporting stack.

Final takeaway

If you’re early-stage and want clarity, calendar-month with proration is a great default. If you’re scaling and fighting 1st-of-month bottlenecks or you want smoother daily cash, same-day-of-month cycles are a legitimate alternative. In either case, write the rules down, model the cash, and make the trade-offs explicit.